Lazada Indonesia

Startup Aims to Be Amazon.com of Indonesia. Lazada Tries to Get a Head Start in a Country Where Just a Third of Population Has Web Access

Executives at Lazada Indonesia, a fast-growing e-commerce startup aiming to be the Amazon.com of Southeast Asia, faced a couple of unexpected challenges when they opened a cavernous new warehouse outside Jakarta last year.

The executives, who hail from Europe, were forced to build a special, refrigerated room after realizing that some perfumes they stocked were evaporating in Indonesia’s tropical heat.

Then there was something even more surprising: Staffers were forced to hold a special ceremony to rid the warehouse of what the staff feared was a ghostly presence lurking in the facility.

Lazada Indonesia, a fast-growing e-commerce startup, operates a 50,000-square-foot warehouse outside Jakarta. (Credit: Newley Purnell / Wall Street Journal)

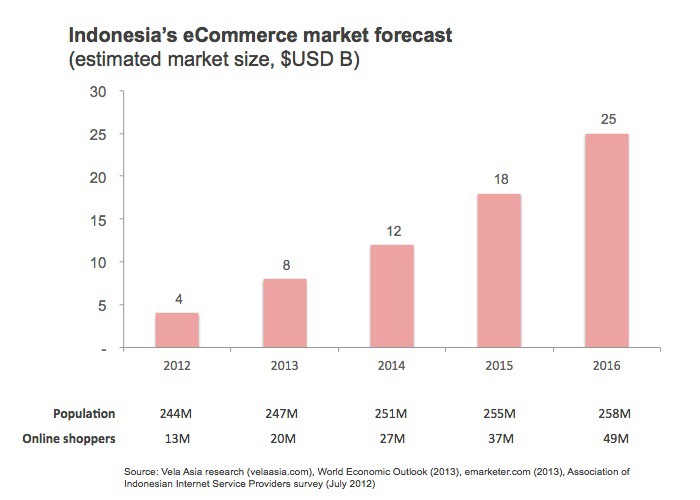

Challenges are par for the course at Lazada Indonesia, founded in Jakarta in 2012 and partly funded by Rocket Internet AG , a Berlin-based tech incubator that went public last month. Indonesia’s e-commerce market is still small, and Lazada had to build a lot of what it needed from scratch. But the company is plowing ahead so it can get a head start in the country over international giants like Amazon.com Inc., Alibaba Group Holding Ltd. and eBay Inc.

Lazada already gets more visitors than any other business-to-consumer site in Indonesia, according to data from research firm SimilarWeb. Lazada’s site saw 6.6 million visitors a month, compared with 3.9 million for Alibaba’s marketplace website AliExpress.com and 2.2 million for eBay, according to the most recent data available from brokerage UBS.

Lazada doesn’t disclose revenue, profitability, or how much business is transacted on its site.

The company aims to capitalize on what many believe is a significant growth opportunity for online shopping in Asia’s third-most populous nation, behind China and India. E-commerce last year comprised just 0.1% of all Indonesian retail, or around $100 million, UBS said in a June report. China’s e-commerce market, by contrast, accounted for about 8% of retail and was worth some $300 billion; in India, e-commerce was about 2.7% of total retail sales, worth around $1.8 billion, according to research firm Gartner.

Magnus Ekbom (right), Lazada’s 28-years-old chief executive, at company’s headquarters. (Newley Purnell/Wall Street Journal)

Indonesia’s growing middle class and the proliferation of low-cost smartphones could boost the share of e-commerce to 8% of retail sales in just a few years, analysts say. That would make Indonesia’s online shopping sector an $8 billion market, the largest in Southeast Asia.

To be sure, about 11% of Indonesia’s more than 240 million people live below the World Bank’s $1.25-a-day threshold for poverty, and about a quarter of the population is near the poverty line. Many don’t have Web connections or disposable income needed to shop online. But household wealth is increasing: 74 million Indonesians live in households that spend more than $200 a month, and that figure will likely rise to 141 million by 2020, Boston Consulting Group says.

Lazada Indonesia’s parent company, Lazada Group, operates shopping sites throughout Southeast Asia and has raised $430 million from Rocket and investors like J.P. Morgan , U.K. retailer Tesco PLC and Swedish investment bank Investment AB Kinnevik. Lazada Indonesia’s chief executive, 28-year-old Swedish national Magnus Ekbom, says he is strongly influenced by Rocket’s go-getter culture.

Lazada Indonesia has grown from five employees to 700 in two years, and is about to move from its 50,000-square-foot warehouse to one more than double in size, executives say.

“Indonesia is predestined for a really massive explosion in e-commerce,” said Maximilian Bittner, chief executive of Lazada Group.

Mr. Bittner said sales have been doubling about every six months in Indonesia, with the company now delivering “well north of” 10,000 orders a day.

Lazada has had to improvise in a country where only 31% of the population has Internet access. It emphasizes mobile apps, since smartphones and tablets, rather than PCs, are many customers’ only gateways to the Web. It has also developed a cash-on-delivery payment system, since only about 6% of Indonesians use credit cards, and many don’t even have bank accounts.

Faced with product shortages early on, Lazada employees say they raided shopping malls, buying products off stores’ shelves to sell on their site. Lazada also unleashed a number of TV and online advertisements that promoted digital shopping and built awareness of its brand.

To stimulate interest in online shopping, executives at Lazada and Zalora—the company’s fashion e-commerce sister company—created a discount sales day on Dec. 12 dubbed 12/12—reminiscent of Alibaba’s Nov. 11 shopping event, which earlier this month logged $9.3 billion in sales at more than 27,000 participating vendors. Lazada said last year about 60 shops joined its event; it doesn’t disclose sales volume.

Lazada’s most formidable challenge, however, was Indonesia’s fragmented and often unreliable shipping network. To cope, it has hired several hundred delivery people to drive its motorbikes and trucks around the country. The company also works with third-party vendors to deliver packages through the country, with most deliveries made within a few days, executives say.

Bigger multinational e-commerce players like Alibaba, Ebay and Amazon may be holding off on Indonesia investments because they feel the market is still too immature, analysts say. Some companies may also be daunted by logistical challenges, or focused on markets like China or India, where growth is still strong, they say.

Amazon, for example, said in July it would invest $2 billion in its India operations. Alibaba in May said it would take a minority stake in Singapore Post Ltd. , the city-state’s main postal service, to create an international e-commerce logistics business.

Alibaba and Amazon declined to comment about plans for Indonesia.

Ebay has a limited local-language site in Indonesia and last year launched a joint venture with an Indonesian telecommunications provider, but more users still visit its main English website, according to SimilarWeb.

“Indonesia has a huge population and the potential to become a very large e-commerce market,” an eBay spokesman said, declining to elaborate on future plans. “It’s just at a very nascent stage.”

—Evelyn M. Rusli contributed to this article.

Write to Newley Purnell at newley.purnell @wsj.com